In our last installment of Follow the CAPEX™ (motion picture rights are still available), we looked at the gargantuan CAPEX spending by the three hyper-scale public cloud companies: Amazon, Google, and Microsoft. That previous post compiled CAPEX spending for the cloud leaders back to 2001 and let us speculate about when they got serious about cloud and what might be their cumulative investments in infrastructure. This post updates that data series with the nearly $45 billion they collectively spent on CAPEX in 2017. See that previous post for the methodological details.

It is mighty expensive to be a software company in the cloud age and the hyper-scale clouds show no signs of slowing down their infrastructure investments. All three companies registered all time highs for CAPEX spending in 2017. It is important to note that none of these companies break out their specific cloud infrastructure investments and all of them spend significant CAPEX on things beyond cloud infrastructure, particularly Amazon where the list is almost endless, so these are gross but directionally interesting numbers.

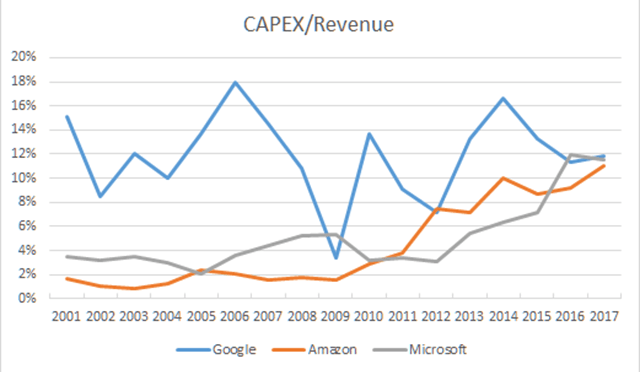

In 2017, Amazon spent $19.7 billion, Google $13.2 billion, and Microsoft $11.4 billion on CAPEX (including capital leases for both Amazon and Microsoft). Those are year-over-year increases of 58%, 29%, and 12% respectively.

While Amazon has been the biggest annual CAPEX spender since 2016, Google still has the most cumulative spend (assuming 2001 as the starting date), but on current course Amazon will take the lead next year (half their cumulative spend has happened in the last two years!). Collectively, these three companies have spent over $195 billion on CAPEX in the last 17 years.

On a percentage of revenue basis, we’re seeing an eerie convergence by all three companies around 12%.

Amazon

The top line Amazon CAPEX number is pretty useless at this point for insights about AWS infrastructure spending. There are just so many other things consuming CAPEX – distribution centers, warehouse robots, grocery stores, cargo jets, office buildings, biospheres, a hyper-segmented line of talking alarm clocks, etc. – that AWS infrastructure is almost certainly a minority of the total company CAPEX. But at a company level, the spend is staggering and is now bigger than any US company I can find except AT&T (and Amazon should pass them this year assuming very low double digit CAPEX growth). This is where Amazon’s cash flow is going.

Given the relative maturity and scale of the AWS business and its fairly consistent growth rates at scale, I suspect AWS CAPEX investment is largely tracking revenue at this point. The capital leases are probably a pretty good proxy for AWS CAPEX ($9.6 billion in 2017).

Google’s CAPEX spiked materially in 2017. Partly this is because they seem to have a three to four year cycle and also I suspect because they have finally accepted the idea of data sovereignty. Google resisted the idea of smaller datacenters in more places for architectural reasons but seems to have finally bowed to customer and government demand.

The other observation for Google is CAPEX associated with their Other Bets declined precipitously by almost two-thirds. Alas, it doesn’t look like we’ll get a space elevator from Google. Bequeathing a space elevator to humanity remains the only acceptable act of Google atonement I can imagine for their role in pioneering the surveillance economy.

Microsoft

Of the three cloud players, Microsoft’s numbers most closely approximate their actual cloud infrastructure spend because they have the fewest CAPEX-consuming extracurricular activities (though a forthcoming campus redevelopment may impact that). Microsoft took an early lead in establishing a broad global footprint and have more regions than Amazon and Google combined, with at least ten more on the way. LinkedIn evidently is continuing to run in its own datacenters, which raises interesting issues for how they will integrate with Dynamics and other products.

For a future installment, I may yet go try to tease Apple’s cloud infrastructure investment out of their total CAPEX spending of $12.3 billion in 2017 (traditionally they spend lots on manufacturing tooling). Or try to make sense of Alibaba Group financial reports to get a handle on their infrastructure investments. Or perhaps look at whether the CAPEX backs up the chatter from cloud pretenders IBM and Oracle.